A peculiar term…

The first time I heard the term fiduciary responsibility was when I was duking it out with the Board of Trustees at Vassar College, attempting to convince them to divest the institution’s sizable 1 billion dollar endowment from fossil fuels. Their jargony, finance-focused counter arguments always centered around this concept. They claimed that their fiduciary responsibility prohibited them (morally and legally) from taking action towards divestment.

So what is fiduciary responsibility anyway? Let’s take a look at etymology first to provide some context:

So what is fiduciary responsibility anyway? Let’s take a look at etymology first to provide some context:

From latin “feducia” which means “trust,” fiduciary in a general sense is “one who holds something in trust.”

According to Investopedia.com, “A fiduciary duty is a commitment to act in the best interests of another person or entity. Broadly speaking, a fiduciary duty is a duty of loyalty and a duty of care. That is, the fiduciary must act only in the best interests of a client or beneficiary. And, the fiduciary must act diligently in those interests.”

Usually a fiduciary is bound to act in a way that will benefit someone else financially; however the benefit need not always be exclusively financial. The nature of the fiduciary relationship is context specific.

Why are we talking about fiduciary responsibility anyway…How can it impact the environment?

The opposite (and complement) of divestment is investment. Both mechanisms can be used as tools to advance environmental causes. Here we turn our focus to investment, and specifically to the ESG (environmental, social, governance) investment strategies of the multi-trillion dollar investment sector: private equity funds.

(A brief note: private equity funds acquire companies with money raised from a broad base of institutional investors, including pension funds. The managers of the pension funds are fiduciaries who have a duty to the pensioners. Also included are university endowments, the trustees of which have fiduciary duty to the institution and indirectly to its students.)

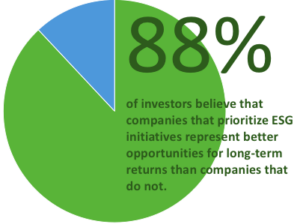

More and more private equity funds have added ESG goals to their profit motive. This means that they will consider the three aspects of ESG mentioned above when choosing investment strategies. They not only want to make high financial returns, but they want to have maximum possible impact along the three ESG dimensions.

Let’s flesh this out a bit…

Environmental: A firm may choose a company that has ambitious GHG emission reduction targets or that sells plant-based alternatives in order to reduce overall consumption of GHG intensive animal products.

Social: A firm may choose a company that elevates underserved communities and empowers members of these communities to get quality jobs within the company.

Governance: A firm may choose a company that emphasizes transparency and aims to reduce inequality by redistributing executive salaries to provide fair pay and benefits to workers at all levels of the corporate ladder.

ESG investment strategies actively funnel capital into business areas that have net positive environmental impact. They harness the power of the market to stimulate areas of the economy that may otherwise be neglected or companies that may struggle to get off the ground.

ESG investing has become increasingly popular in recent years as people become more aware of the potential of their investments to actively do good alongside the original goal of profit generation.

ESG investment is sensitive to the regulatory landscape…

The ability of companies to invest according to ESG principles is very sensitive to the political/regulatory landscape.

During some of the final days of his administration, for example, former president Trump established a new rule through the United States Department of Labor’s Employee Benefits Security Administration that effectively prevented ESG investments from being included in retirement portfolios by setting a more restrictive standard for fiduciary responsibility. This rule made it so that fiduciaries could not consider ESG impact in their investment decisions.

(This was likely part of Trump’s fossil fuel agenda and it essentially forbade divestment measures in pension funds.)

This was not a popular move. The rule was pushed through extremely quickly and with very little support. It only allocated a 30-day comment period. However 95% of the comments received were in opposition to the rule.

On president Biden’s first day in office it was announced that the DOL rule was one of Trump’s actions that Biden would likely reverse. On March 10, 2021 the DOL’s EBSA announced that it would not enforce the Trump-era rule.

It is expected that more new rules will be made in this area, perhaps rules that formally nullify Trump’s rule or ideally rules that even advance the ESG movement.

Who’s right?…What should the standard for fiduciary responsibility be?

I personally believe there are a few different reasons why fiduciary responsibility allows for ESG investment practices. In other words, fiduciary responsibility and ESG are not incompatible.

Let’s return to Vassar for a moment and take its fossil fuel divestment campaign as an example. The duty of the fiduciaries, the guardians of the College’s endowment, is to look out for the best interest of the institution and students in this case. Thus, in my mind it is clear that they not only have a responsibility to make the investment decisions that will generate high returns for the endowment, but also to make investment decisions that have a greater chance of positively impacting the world so that the students have a stable planet on which to live and work now and in the future. Profit should not be the only motive.

And what is the relationship between ESG impact and profit? I (and a great many others) would argue that they are two sides of the same coin. Incorporating ESG considerations into investment decisions will actually help increase and/or protect profit margins. ESG is lucrative.

- Risk

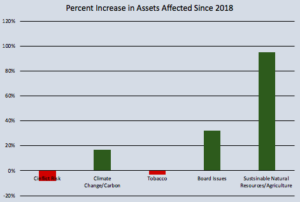

The first reason for this is that ESG investments are often less risky. The carbon bubble, for example, is bound to burst eventually, and the timing is uncertain. A portfolio that emphasizes renewables over fossil fuels might avoid the worst of the impacts when this comes to pass. Also, the prospect of increasingly strict environmental regulation looms on the horizon. Sooner or later, depending on the political ebb and flow, regulations will be put in place that make irresponsible companies pay a price for their negligence. ESG companies will reap the benefits of this.

- Long-term sustainability

Social and environmental sustainability are precursor to economic sustainability and stability. Companies that consider ESG are more intentional and consequently likely to last and return profits over time.

- Market forces and trends

All consumers, but especially younger consumers such as millennials are increasingly interested in ESG, perhaps an outgrowth of their passion for social justice causes. This trend is likely to continue as consciousness grows along with the urgency of issues such as climate change. To go against ESG now is to swim against the current.

What can the average person do about all this?

There will likely be more rule-making in the ESG area. If you are interested in the topic, keep your eyes on the news and look for opportunities to leave public comments on new rules when they are proposed.

Many working Americans look to pension funds to finance their retirement. As beneficiaries of these funds, you can always choose to make your voice heard as to the ESG impact you would like your pension to make when the money is invested. Don’t be afraid to be vocal. ESG gives you an opportunity to put your money where your mouth is.